DeFi Weekly #12 — Elon’s influence over crypto

It’s not uncommon anymore and not the first time either that macro events and internet personalities have impacted crypto. In fact, as crypto continues to evolve, macroeconomics like equity and credit markets will play a more prominent role than the attention it gets from most people.

Elon Musk has been fiddling with the crypto space since 2014, but it was not till 2019, during the conversation with ARK Invest, that Elon took crypto’s side and got a lot of hype and fans from the crypto community. Since 2020, Elon has been more vocal about crypto and has had an enormous impact; let’s take a walk down the memory lane.

Bitcoin (BTC)

- January 29th: Adds #bitcoin to his Twitter bio and posts a tweet that pushes the price of BTC by 20%.

- February 8th: Tesla announces the purchase of BTC, pushes the price by 18%.

- April 27th: Tesla sells 10% of BTC to test market liquidity. Elon tweets, he has not sold his BTC, the price stays stable.

- May 12th: Musk tweets that Tesla suspends purchase through BTC due to environmental impact. Price drops by 15%.

- May 16th: Further suggests that Tesla may sell the remaining BTC holdings. Price drops by 12%.

- May 24th: Conversation with North American BTC miners to discuss sustainable mining. Price rises by 15%.

- June 4th: Shares a breakup with BTC meme. Price falls by 20%.

- June 13th: Replies Tesla to accept BTC if >50% of energy from mining comes from renewables. Price rises by 15%, breaking a major resistance.

Dogecoin (DOGE)

- July 18th, 2020: Doge against financial institutions meme, price rises by 20%

- April 1st: Doge to the moon meme. Price jumps by 30%.

- April 24th: Doge at SNL announcement tweet, price rises by 15%.

- May 8th: Calls Doge shilling a hustle. Price drops by 28%

- May 10th: Announces SpaceX will launch Doge-1 to the moon. A 10% rise.

- May 11th: Runs a poll if Tesla should accept Doge. Price jumps by 20%.

- May 20th: Doge to 1$ cyberviking meme. Price jumps by 30%.

- May 24th: Opens Doge Github suggestions. A 20% increase in price.

CumRocket (CUMMIES)

June 5th: Posts an explicit emoji and takes CumRocket to the moon. A 400% increase.

Love it or hate it, but you can’t ignore that Elon has power over crypto.

DeFi Stats

Top DeFi updates

0x Project integrates with Polygon

With a mission to bring 1M users onto 0x powered applications running on Polygon Network, a $10.5M in joint funding is allocated to 0x DAO. The move aims to allow users to access the 0x ecosystem with Polygon’s speed and lower gas fees. The funding will be governed by ZRX holders and will be used towards Polygon benefitting initiatives. In addition, 0x DAO will monitor transparent accounting, management, and communication around the funding.

Curve launches V2

V2 introduces Transformed Peg Invariants, an innovation to allow high liquidity among differently priced assets. While there is a lot of confusion on the technical aspects, fundamentally, the TriCrypto pool will allow for seamless transactions with low slippage and high liquidity between Bitcoin, Ethereum, and USDT (Stablecoins), the most liquid assets in the space. Furthermore, the algorithm will compute the price by relying on internal oracles and Exponential Moving Averages (EMAs). The pool is already live on Polygon for the brave-hearted.

1 Inch releases limit order protocol

The updated protocol will replace the legacy solution and allow users to buy and sell crypto assets at a specific price. The limit order protocol currently supports most token standards and is available on Ethereum, BSC, and Polygon Networks. Two major features which distinguish it from other limit order protocols include:

- Dynamic prices → A custom price function for users based on demand, supply, oracles, etc

- Conditional execution → Allow for users to enable arbitrary conditions

Users can also implement stop-loss, trailing stop orders, etc., leveraging these features.

DeFi Dose: Concentrated Liquidity

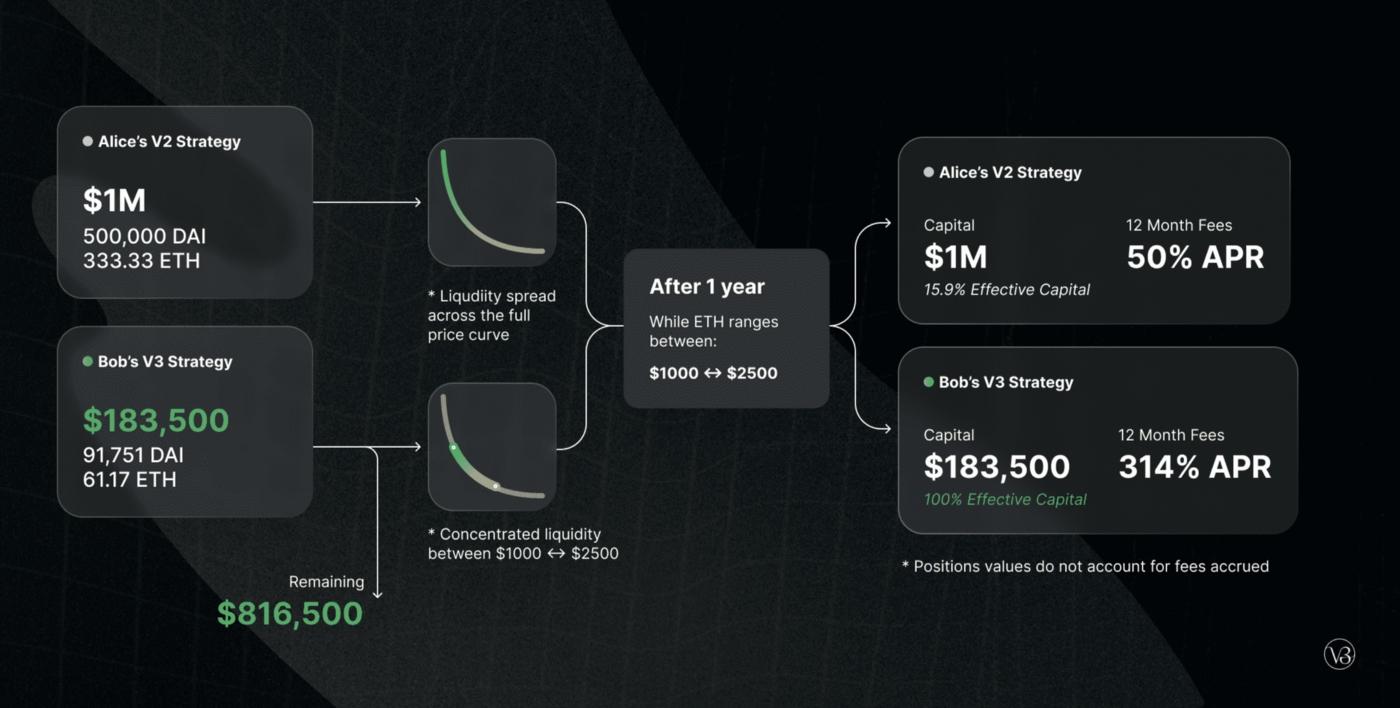

Uniswap V3 was the first product to introduce concentrated liquidity, with the fundamental idea to increase capital efficiency in liquidity pools. When LPs provide liquidity in V2 pools, the liquidity is evenly distributed along the price curve from zero to infinity. However, most assets trade between a specific price range, making the capital beyond the price range inefficient and, in most cases, never unitizing it.

For example, in the USDT/USDC pool, the price ranges between $0.99 — $1.01; most of the volume and the fees for LPs come from this range.

Concentrated liquidity allows LPs to allocate the capital in custom ranges to maximize gains and lower risk. In V2 pools, LPs had to create custom pools that could sometimes increase gas fees and impermanent loss due to the trading route. The concept is abstracted for users who are trading by allowing them to trade against the combined liquidity.

About ClayStack:

ClayStack is a decentralized liquid staking protocol that enables you to earn staking rewards while keeping your assets liquid. Without any lockups.

Get the latest updates!

Learn more about ClayStack, interact with our team, engage in community discussions, and share your valuable feedback.

- Telegram: https://t.me/claystack

- Twitter: https://twitter.com/ClayStack_HQ

- Website: https://claystack.com/

- Announcements: https://t.me/claystackchannel

- Alpha testnet: https://claystack.com/contact/alpha_tester